Welcome to passive income!

Fintech Private Investor Opportunity

Welcome to passive income!

Welcome to passive income!

Welcome to passive income!

Blockchain "mining" is a metaphor for the computational work that network nodes undertake to validate the information contained in blocks. Crypto miners are essentially getting paid for their work as financial auditors. They are conducting the first verification for Bitcoin or like coin transactions, opening a new block, and being rewarded in payment daily. Networks are secure because miner computer nodes number in the millions around the world making it virtually impossible to hack since each are verified by others. No one bad actor can take over that many computers.

Crypto Mining Disadvantages NYMC Has Overcome

Expensive energy usage

Greater barrier to entry

Reduced hosting rates by 38%

Escaped unreliable Texas ERCOT electricity

NYMC has a major competitive edge @ $0.0477 per kwh

NYMC will expand while others are unplugging

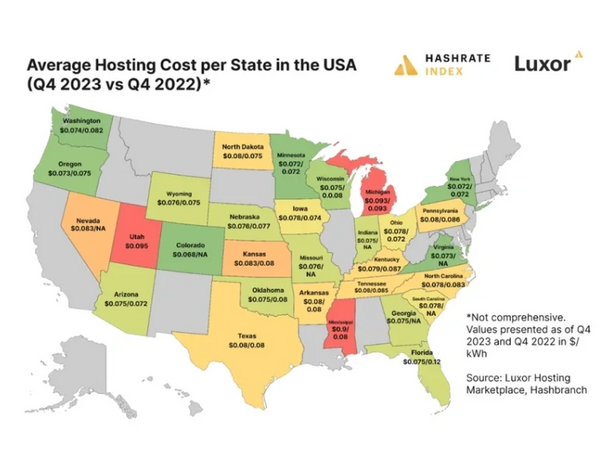

Retail hosting-as-a-service will decline as lower mining margins squeeze out both hosts and clients. In 2023, the average all-in hosting rate was $0.078/kWh in the US and $0.072/kWh in Canada; in Q4-2023, the average all-in rate was $0.078/kWh and $0.071/kWh, respectively.

$100k UNSECURED 15% yearly return with 1 year lock in

$100k SECURED 7.5% yearly return 1 year lock in (limited to NYMC assets as collateral)

$100k EQUITY ONLY increments for 1% equity in NYMC up to $500k or 5% equity total per investor

Rule 506

Issuers may raise an unlimited amount of money in offerings relying on one of two possible Rule 506 exemptions—Rules 506(b) and 506(c). An issuer relying on Rule 506(b) may sell to an unlimited number of accredited investors, but to no more than 35 non-accredited investors.

Accredited investor. One reason these offerings are limited to accredited investors is to ensure that all participating investors are financially sophisticated and able to fend for themselves or sustain the risk of loss, thus rendering less necessary the protections that come from a registered offering. An individual is an accredited investor if they:

A spousal equivalent means a cohabitant occupying a relationship generally equivalent to that of a spouse.

Any non-accredited investors in the offering must be financially sophisticated or, in other words, have sufficient knowledge and experience in financial and business matters to evaluate the investment. This financial sophistication requirement may be satisfied by having a purchaser representative for the investor who satisfies the criteria. An investor engaging a purchaser representative should pay particular attention to any conflicts of interest the representative may have, such as having a financial interest in the offering or separately being compensated by the issuer.

If the issuer offers securities to non-accredited investors, the issuer must disclose certain information about itself, including its financial statements. If selling only to accredited investors, the issuer has discretion as to what to disclose to investors. Any information provided to accredited investors also must be provided to non-accredited investors.

Issuers relying on the Rule 506(b) exemption may not generally solicit their offerings. However, the Rule 506(c) exemption permits the issuer to generally solicit or advertise for potential investors. As a result, you may see an investment opportunity advertised through the Internet, social media, seminars, print, or radio or television broadcast. Only accredited investors, however, are allowed to purchase in generally solicited offerings under Rule 506(c), and the issuer will have to take reasonable steps to verify your accredited investor status.

John Bartolini Sr.

Founder

Chief Executive Officer (CEO)

153 East Main St

Jefferson Valley, NY 10535

Westchester Couny, NY

Email bartolini@optonline.net

Cornell University, Ithaca NY

Pace Law School, White Plains NY

John Bartolini Jr.

Chief Operations Officer (COO)

Email jjbart2005@gmail.com

Army ROTC Cadet Cybersecurity Major

University Of Tampa, Florida

Gino Valverde

Investor Relations

Houston, Texas

917.208.7200

Cornell University, Ithaca NY

Copyright © 2024 NY Metro Cloud LLC - All Rights Reserved.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.